Rewards Credit Card for USAA's Affluent

PROJECT OVERVIEW

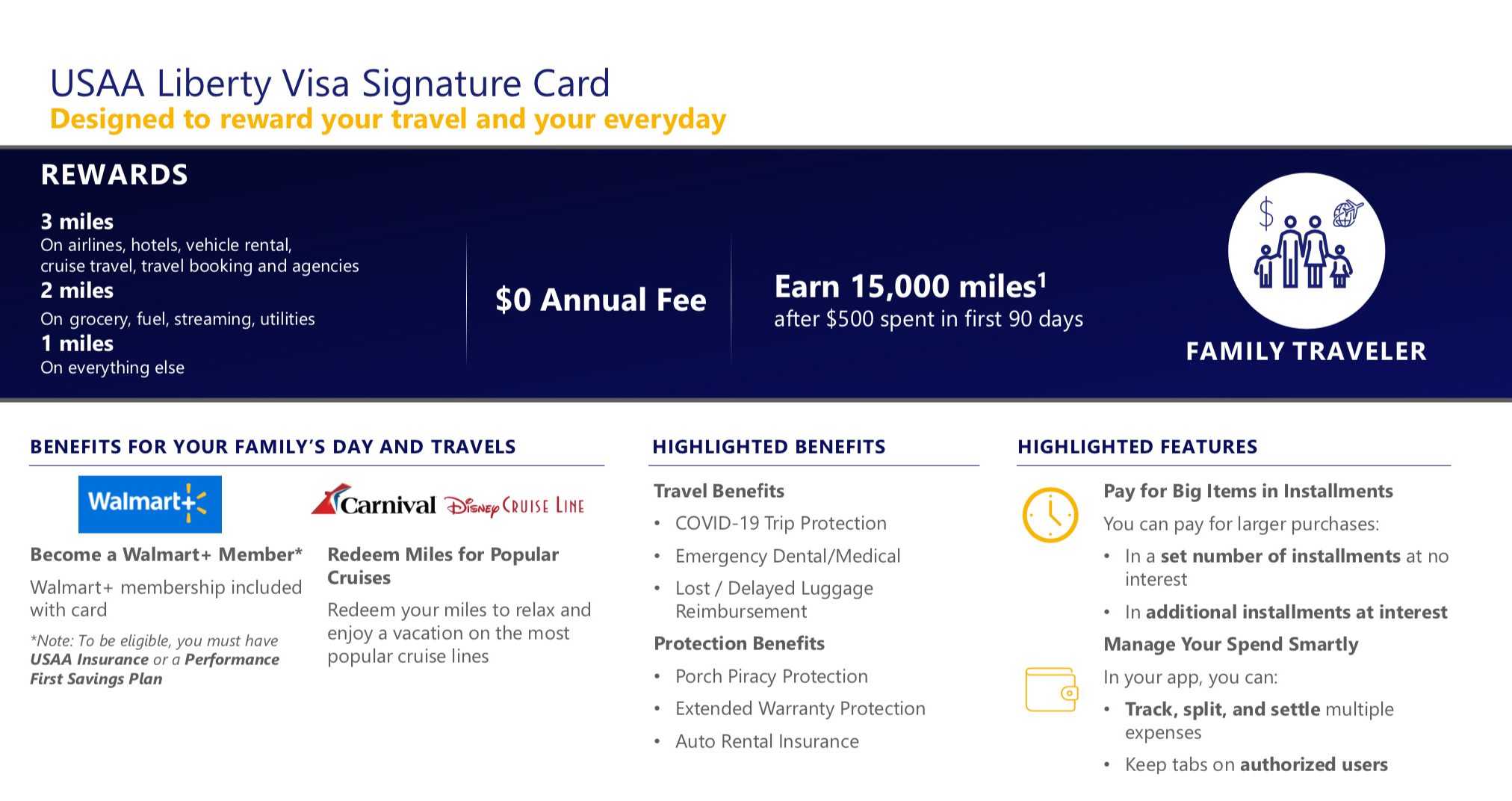

A credit card for USAA’s affluent focused on travel rewards — with a new redemption platform, card design and payments integration that drives top of wallet status.

How might we ... meet the needs of an under-served affluent population while still maintaining a profit?

A credit card for USAA’s affluent focused on travel rewards — with a new redemption platform, card design and payments integration that drives top of wallet status.

How might we ... meet the needs of an under-served affluent population while still maintaining a profit?

MY IMPACT

- My design strategy & member research defined the product direction for the credit card launching in Q2 2023

Why a Rewards Credit Card?

From ‘17 to ‘22, USAA’s card portfolio saw a -$1B decline in profit regulation status as membership doubled from 5M to 10M, 2) increase in compliance/risk practices company-wide meant lack competitive products & deprioritization of revenue streams. USAA saw a x% decrease in customer loyalty and shrinking pocket books due to operating expenses exceeding revenue by 36%.The Challenges

PORTFOLIO CHALLENGES:

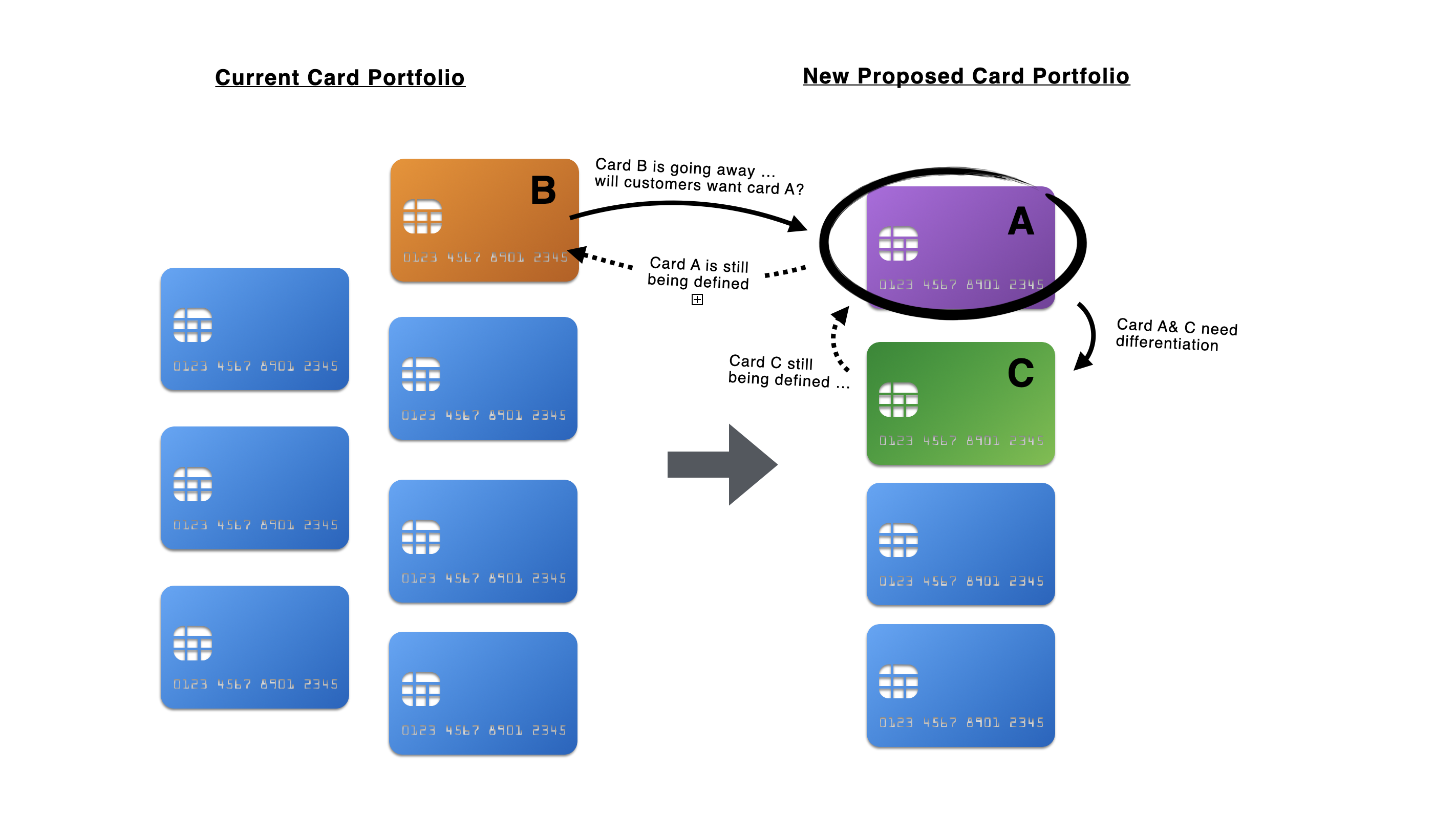

- Portfolio needs to consolidate cards to reduce operational costs

- Card portfolio needed cash and 1.2M high spending members with no product to meet needs

- Everyday Rewards Card and Travel Rewards Card needed differentiation to not canabalize

- Sunsetting Eagle Points Card holders to appropriate card?

- Old rewards redemption platform sunsetting, integrating a new one

- New API integration delayed the product launch

BEAHAVIORAL CHALLENGES:

- Senior leaders unfamiliar with generative research

- Human-centered product muscles atrophied during compliance hiatus

HYPOTHESIS:

USAA has the market for an affluent credit card and it will generate revenue.

RISK:

We don’t know the behaviors nor needs of our affluent members to build a tailored product.

SUCCESS MEASURES:

- 1% increase in new aquisitions per affluent segment (SOM = 1.2M members)

- % increase in payment volume of card portfolio per affluent segment (Industry 20.8% vs USAA 16.7%)

- % increase in annual spend per active card of affluent segment by 5% (Industry $48.1k vs USAA $42.6)

What I Did

Alignment ︎︎︎ Discovery ︎︎︎ Definition ︎ Roadmaping ︎ Implementation

ALIGNMENT:

Methods used: market research, segmentation, analyze existing qual & quant research, ideation, facilitation, competitive analysis

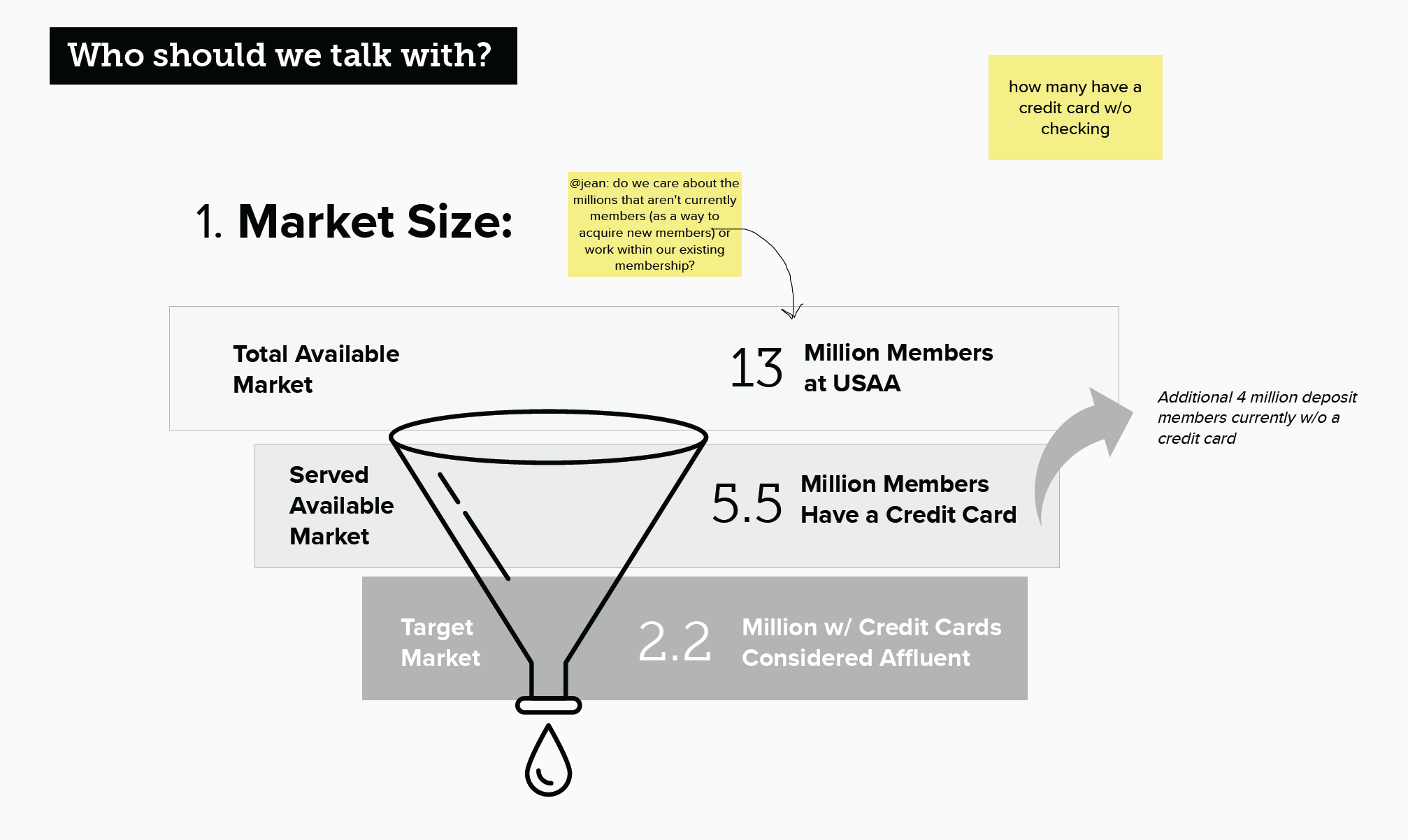

Understanding the Market Opportunity

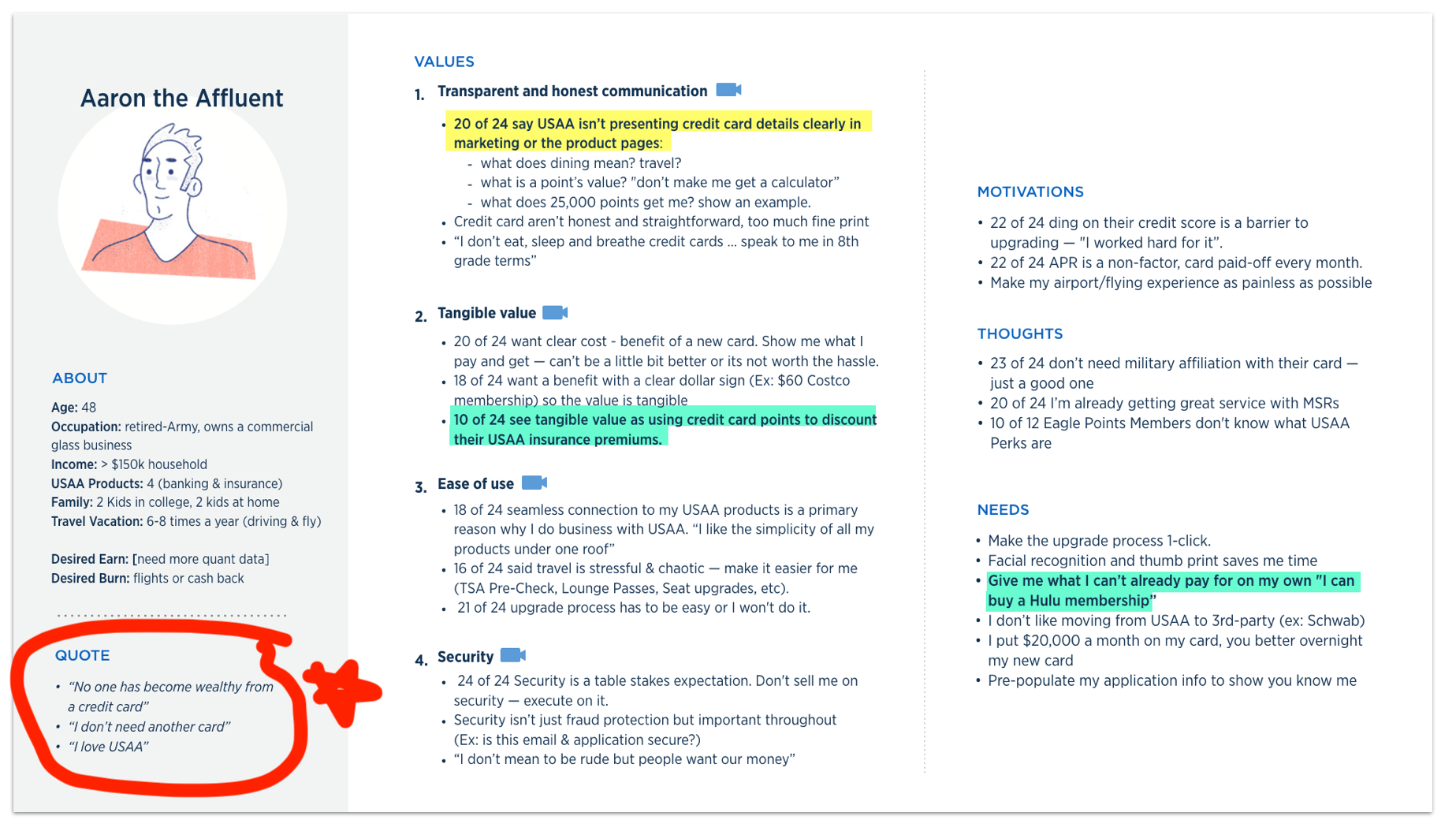

USAA’s Business Intelligence team identified a gap in the market for USAA’s affluent members, but the senior leaders didn’t know what type of credit card to offer them.

More than 1.2M Members fall into the Affluent segment are dormant or have low usage on their current USAA credit card because our products do not meet the needs of the affluent.

More than 1.2M Members fall into the Affluent segment are dormant or have low usage on their current USAA credit card because our products do not meet the needs of the affluent.

Target Market size: 1.2M of 13M members

Target Market defined as:

- >$150k household income

- >$500k total assets or average daily balance (excludes home or 401k)

- >$5k in monthly card spend or 10k credit limit

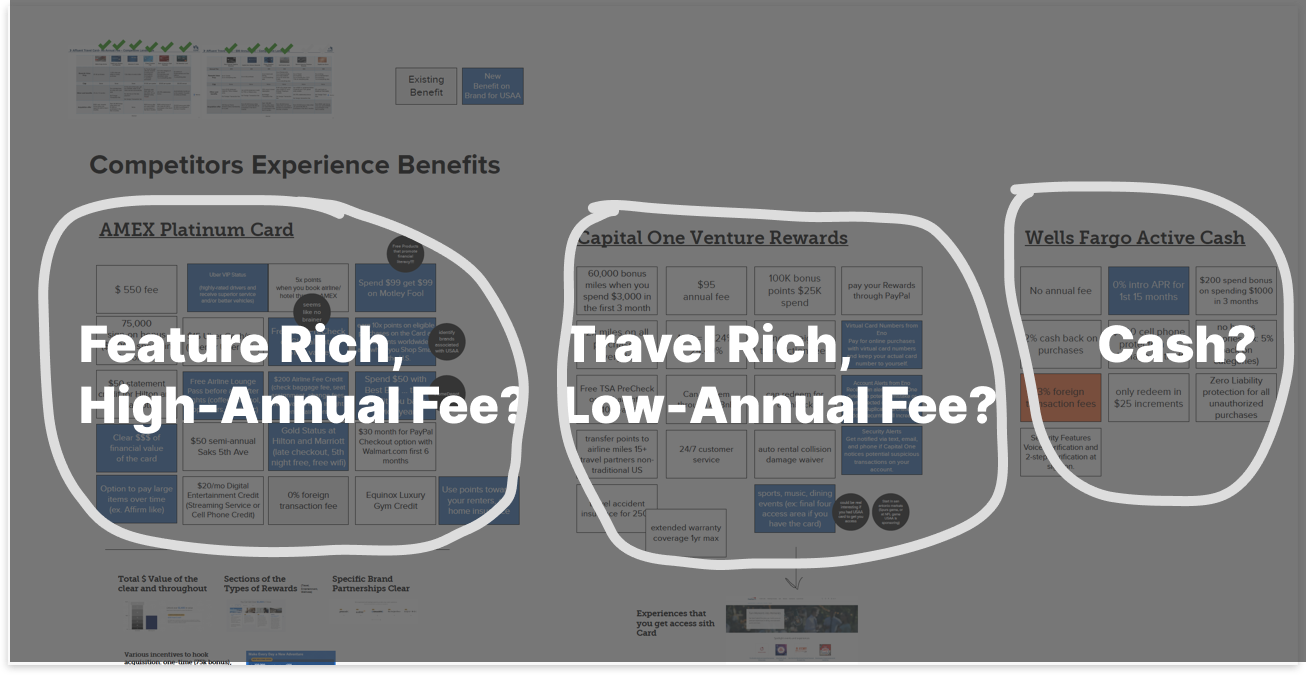

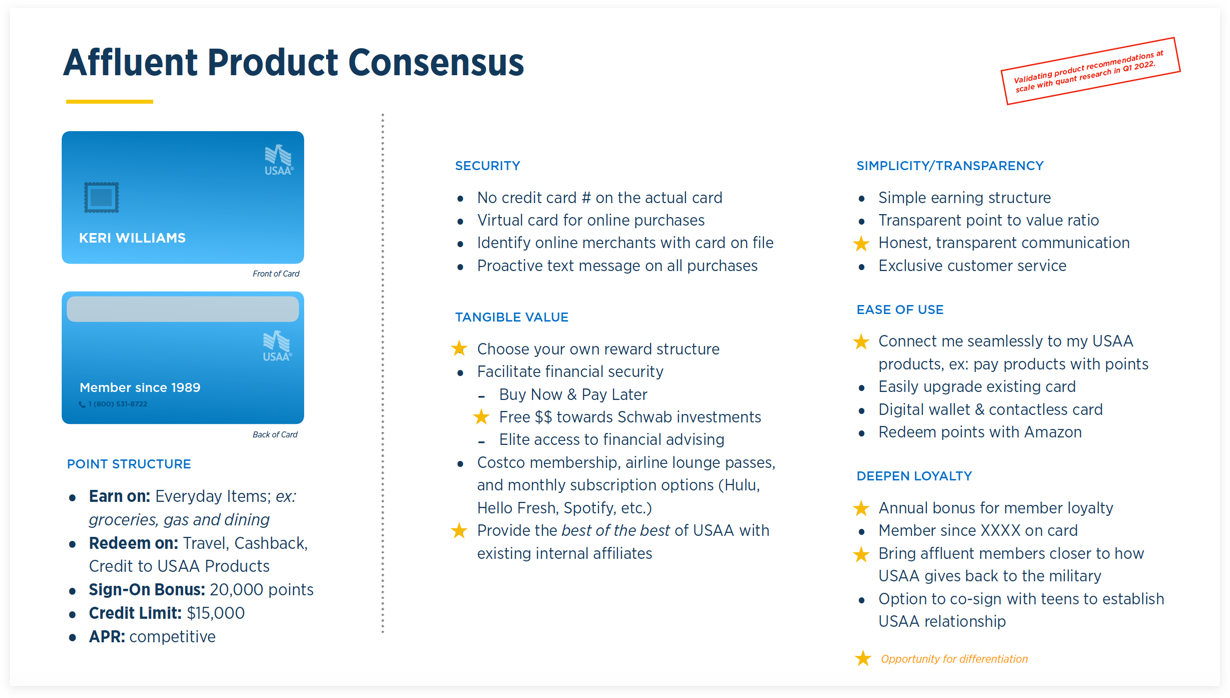

What card do they want?

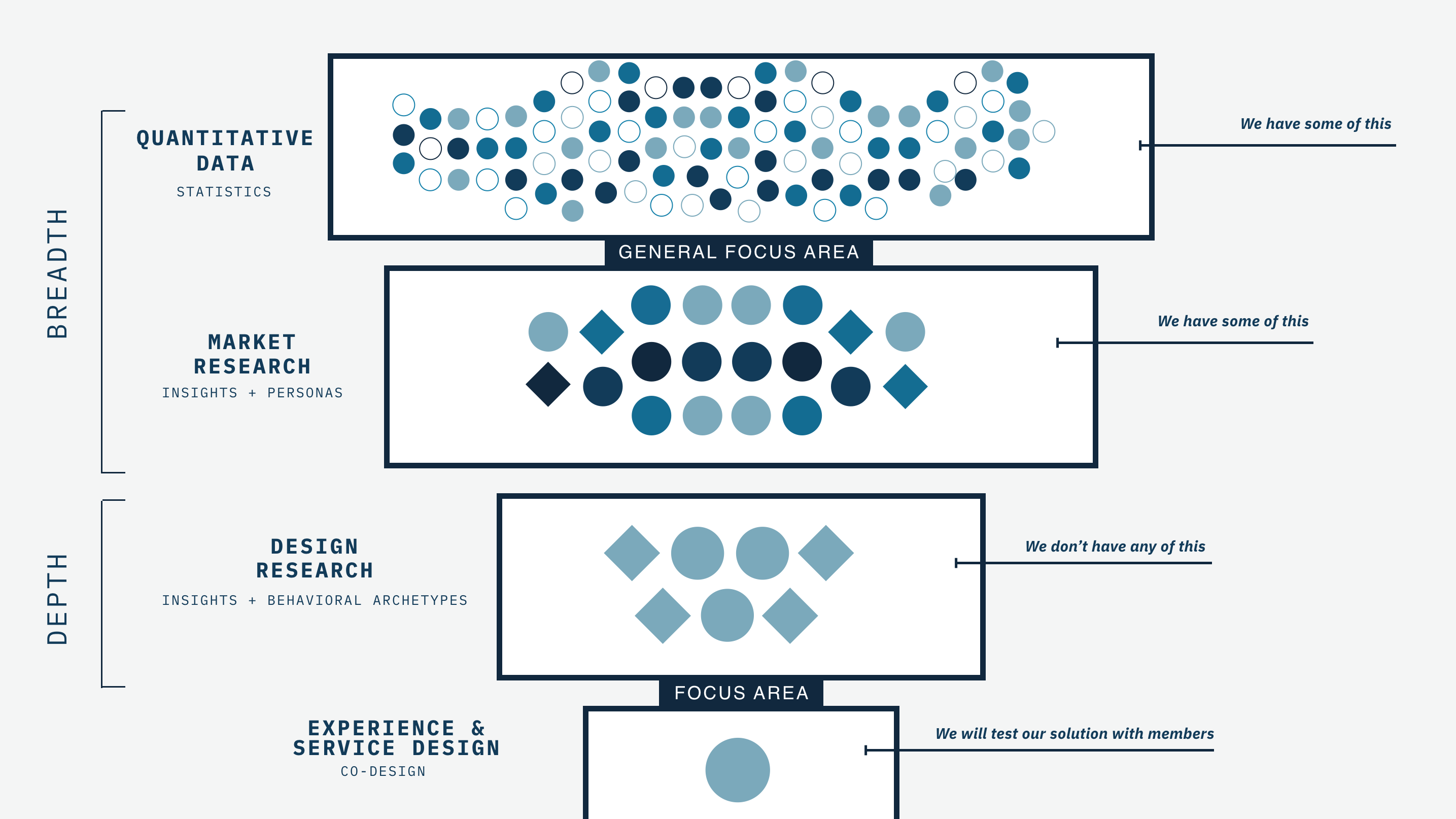

What Do We Know? Existing Data ...

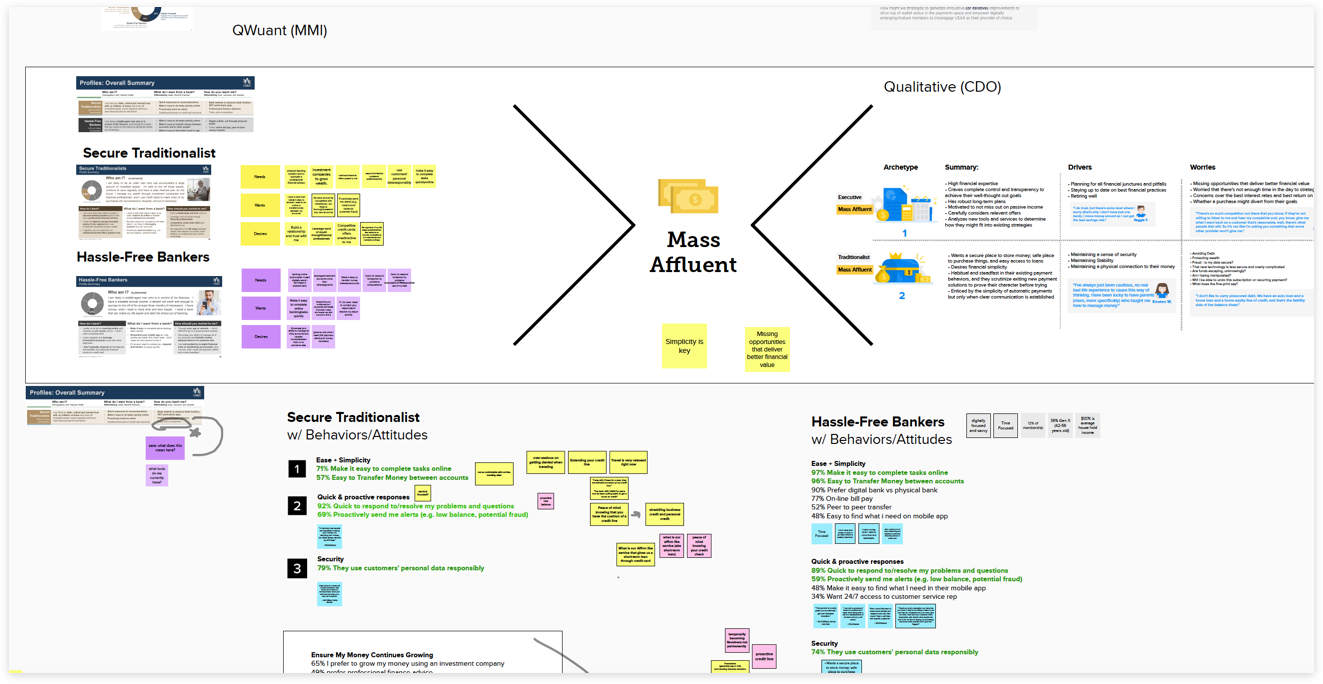

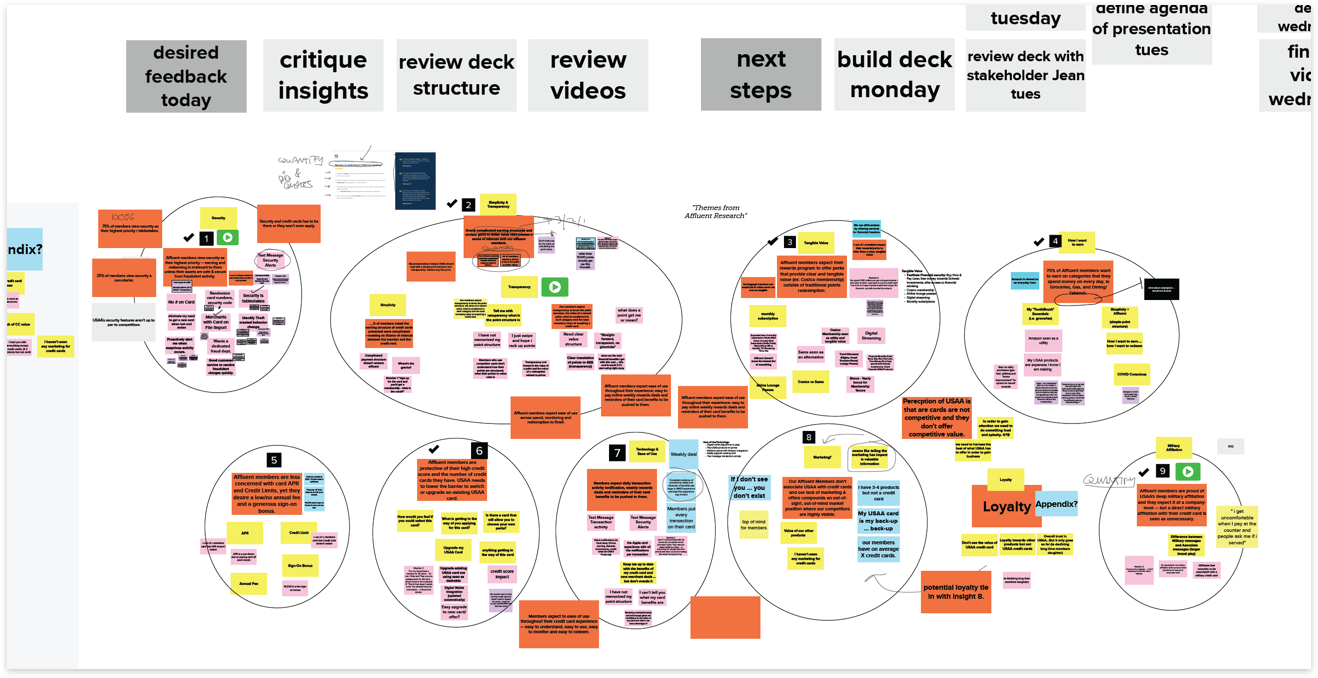

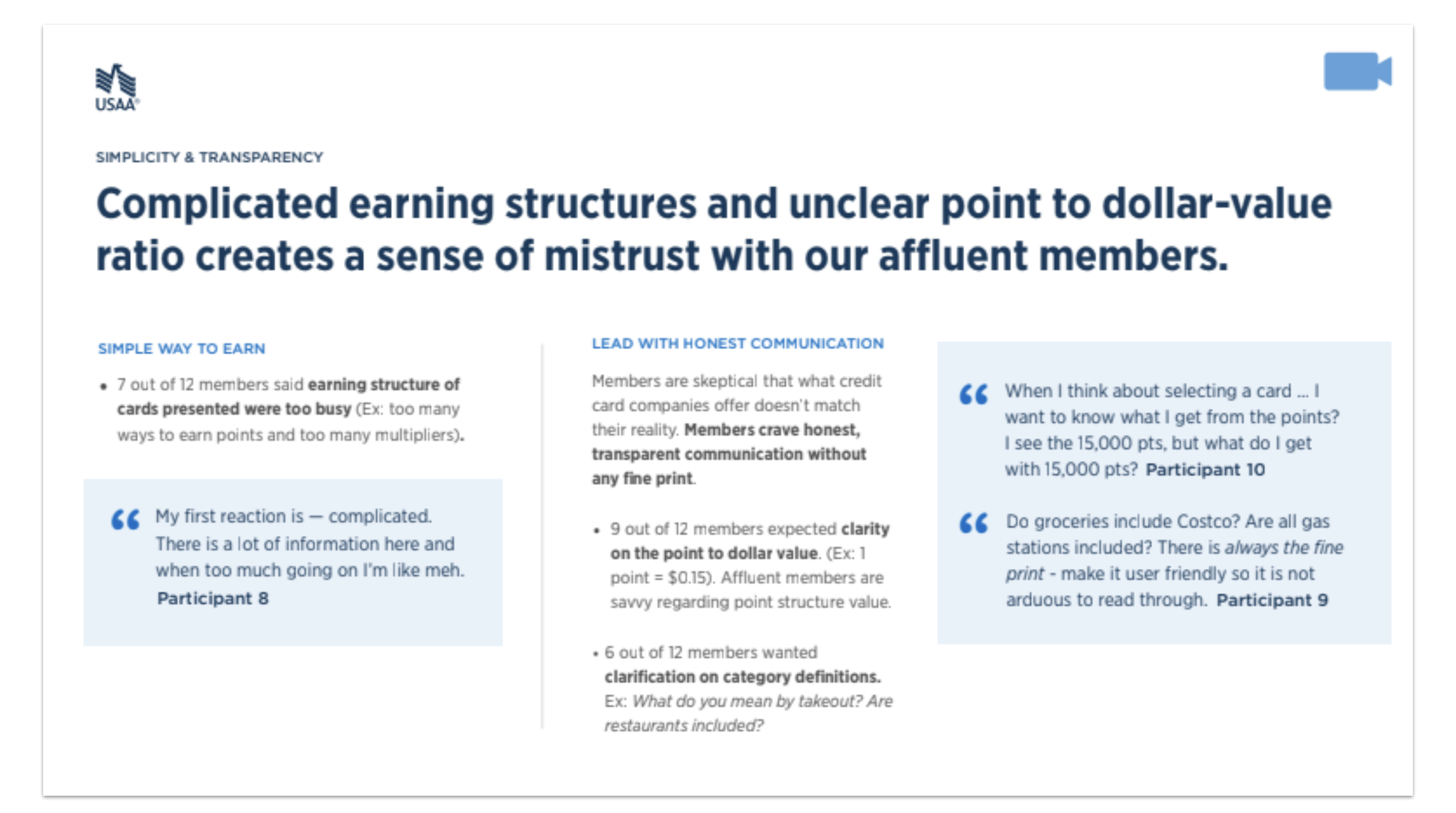

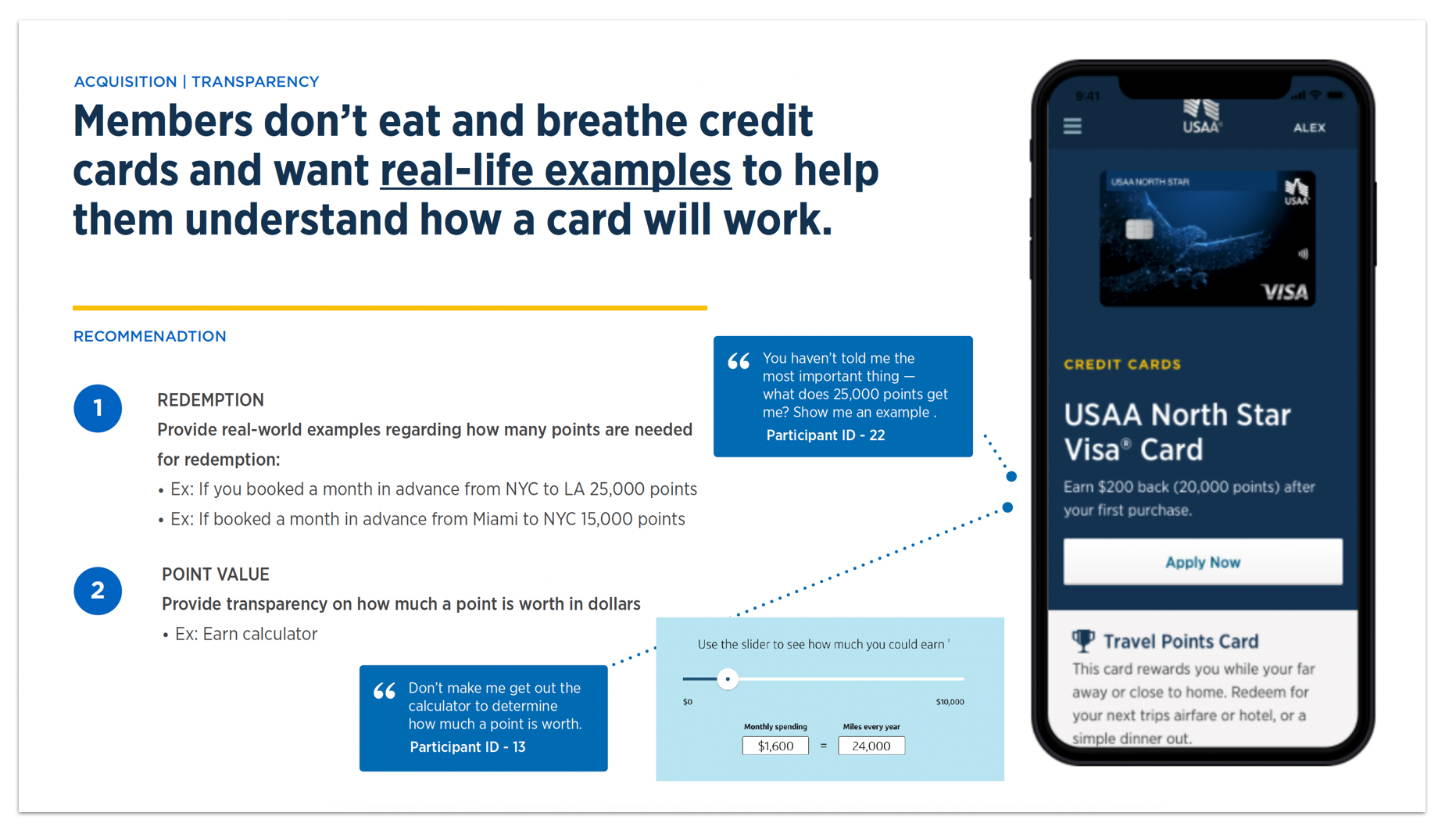

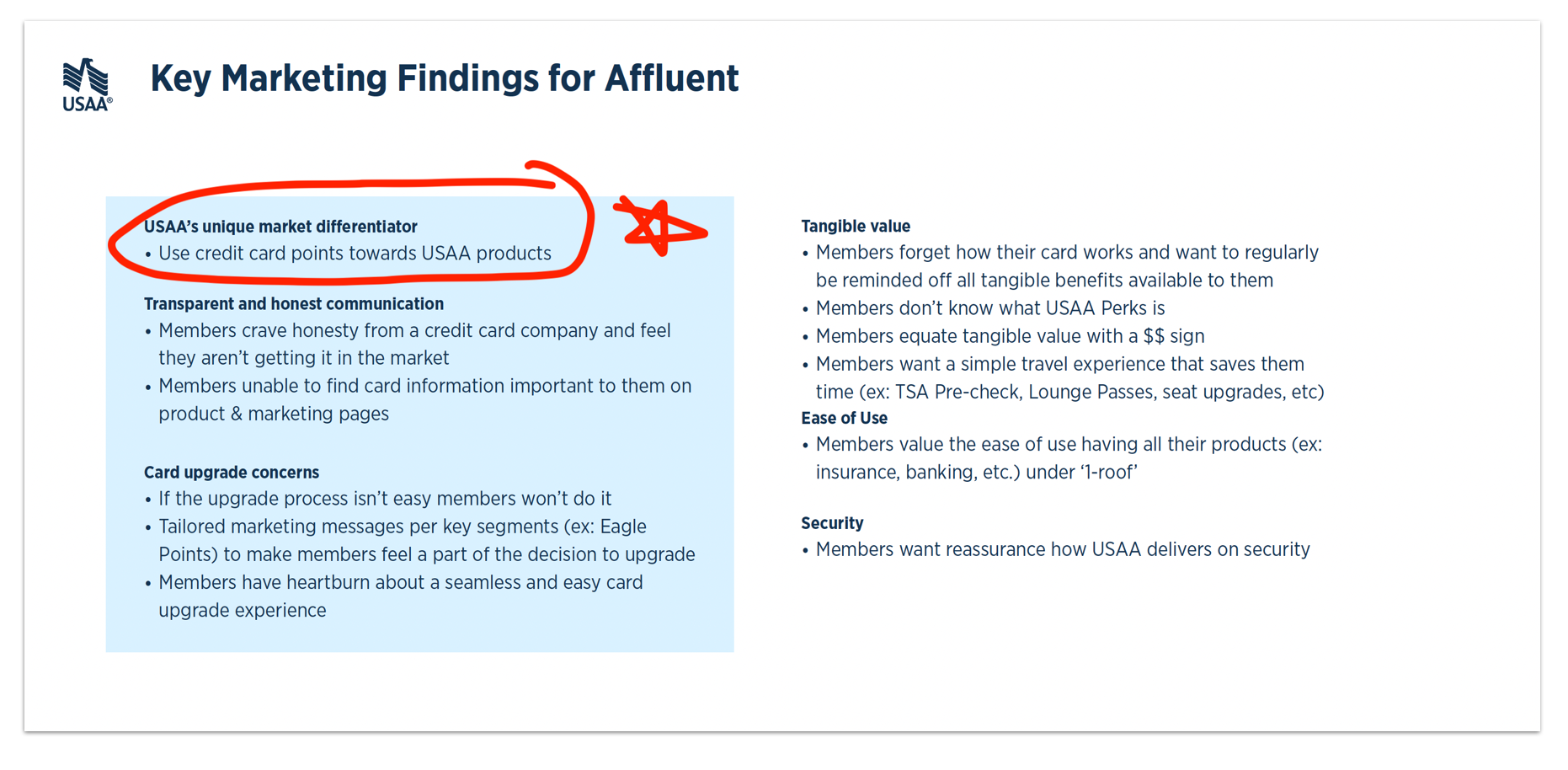

We had a decent understanding of high-level needs of affluent but not specific enough to make confident design decisions off.

Previous Quant/Qual Reports

3-year old research gives us a decent understanding of the leading needs of our affluent, but 3 years is a long time in product world.

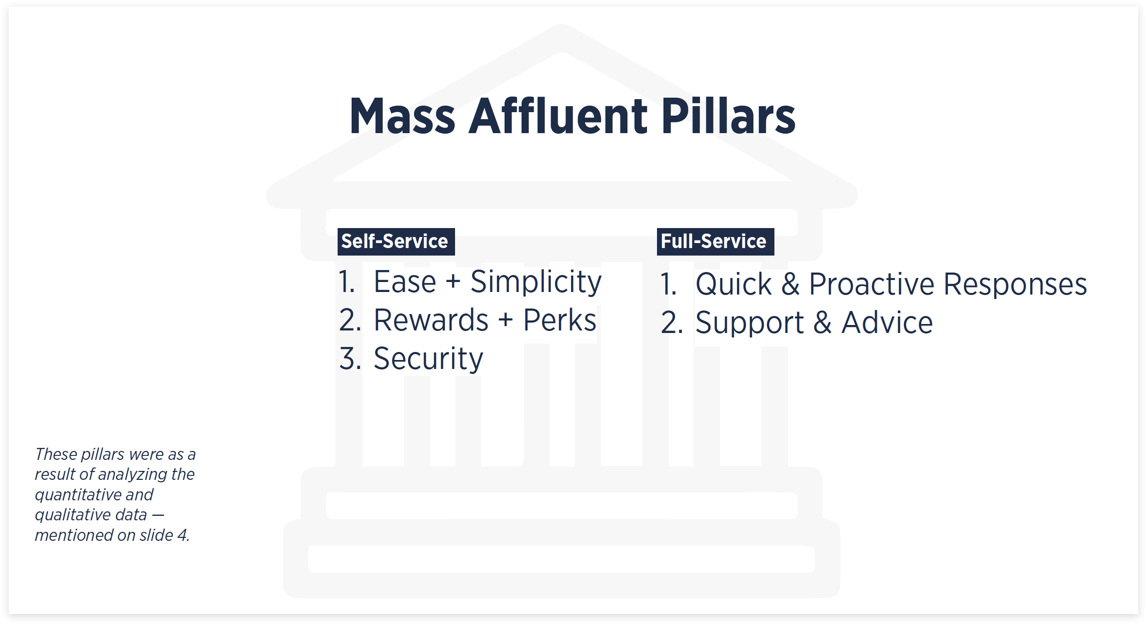

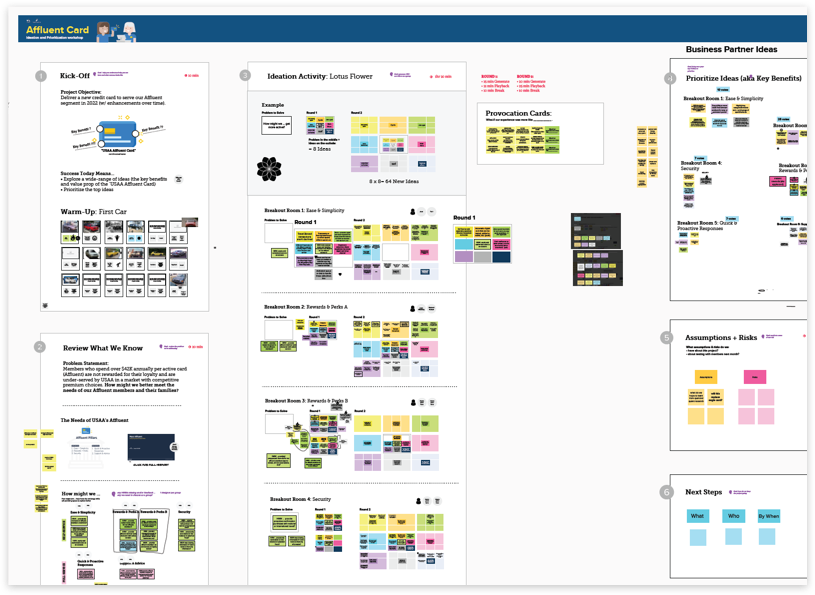

Alignment Workshops Before Member Interviews

Tested the pillars with internal senior leaders closest to the problem, getting their ideas, buy-in and leads towards additional data

DISCOVERY:

Methods used: generative research, synthesis, co-design, quantitative research

Methods used: generative research, synthesis, co-design, quantitative research

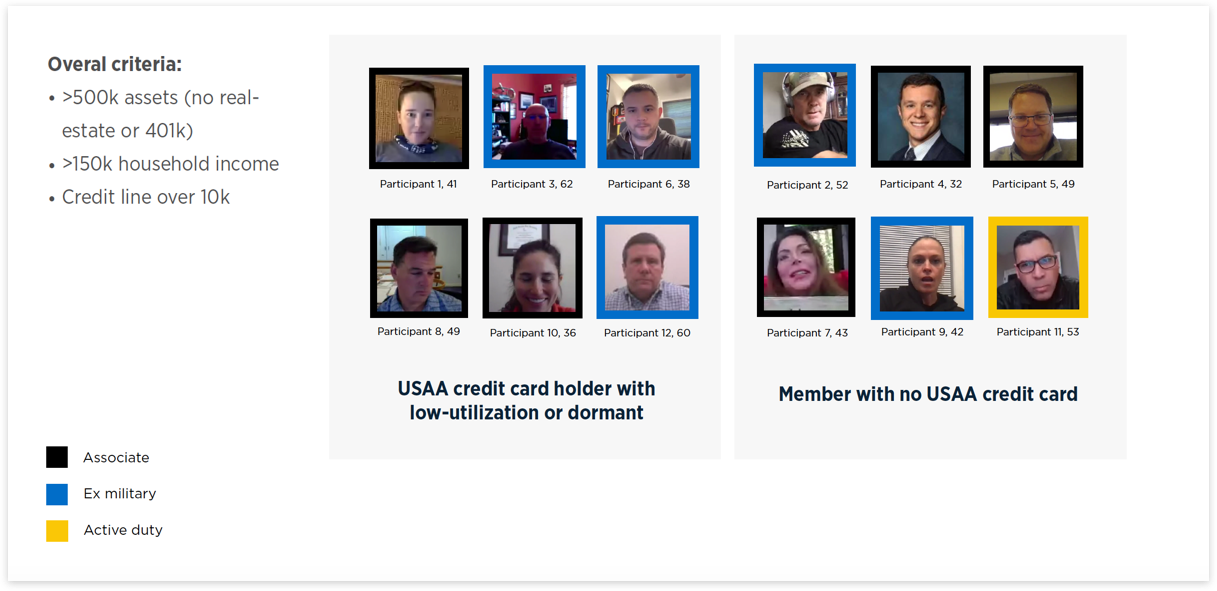

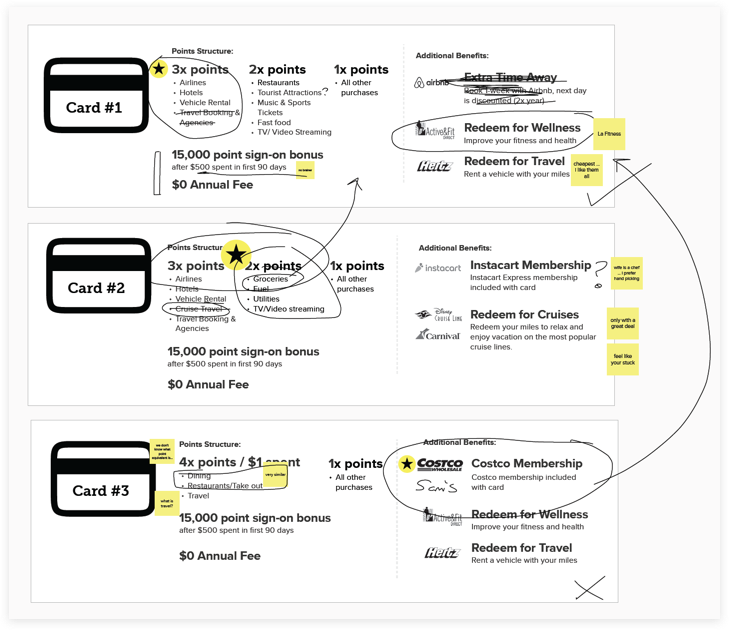

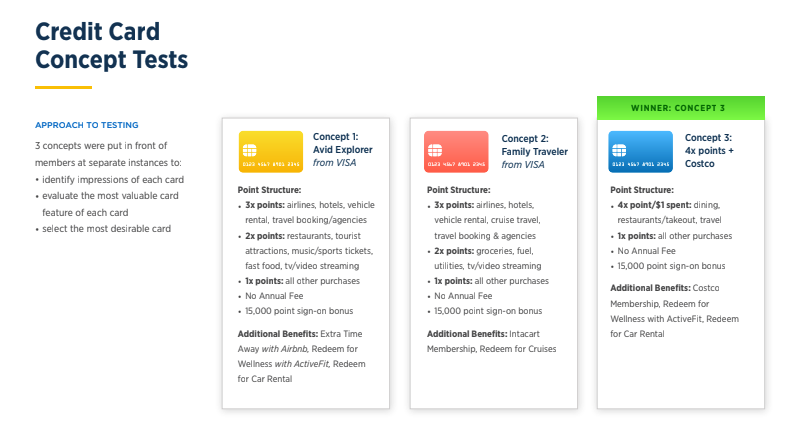

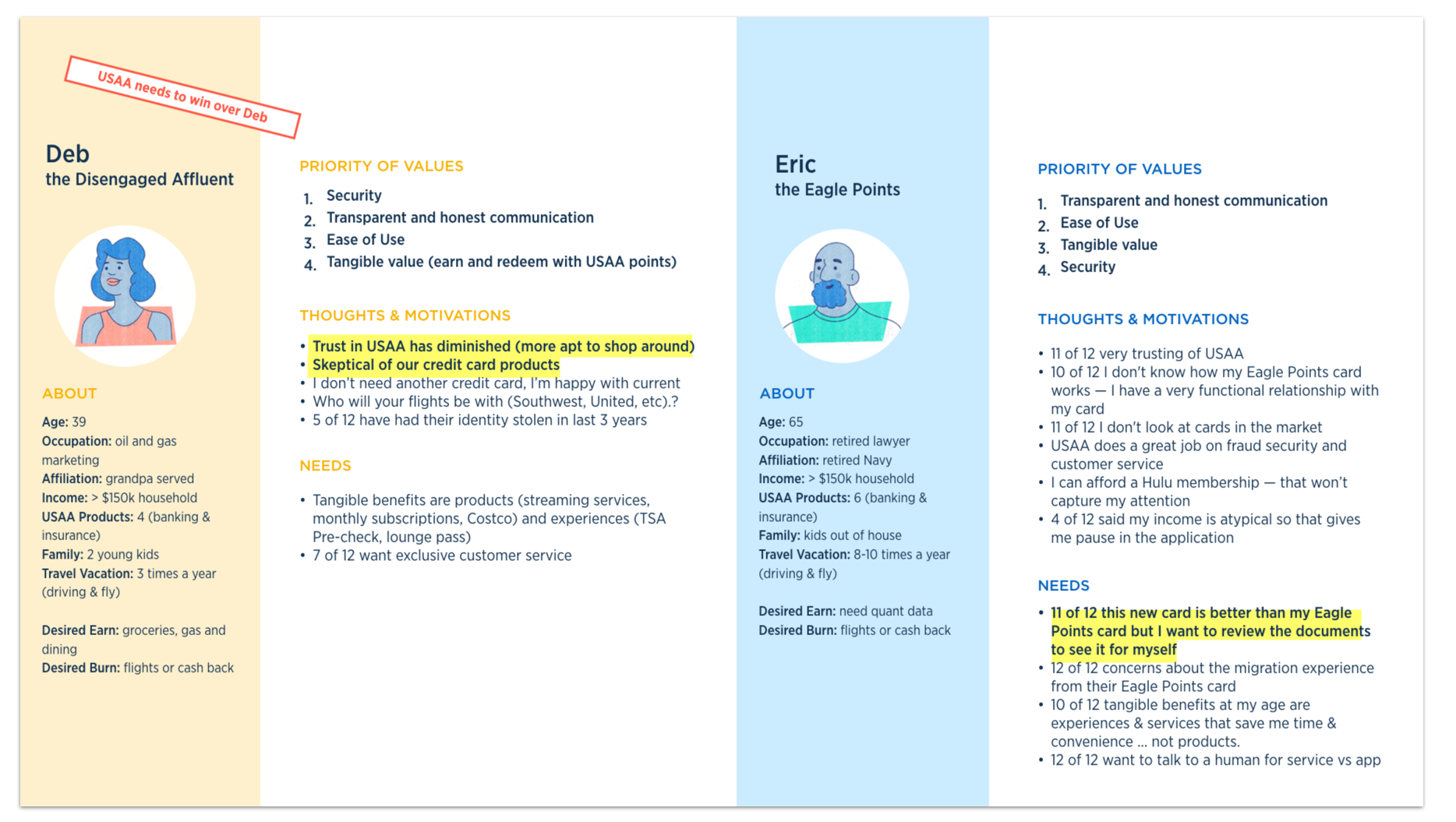

Qual 1: Disengaged Affluent

Background:

Learn why low-usage and dormat don’t use their USAA credit card and what would be desirable. Low usage members would give us an honest perspective as to what they were using in the market.

Research Goals:

• Understand earn & burn behavior

• Test Visa card concepts

• Co-design member’s ideal card

• Understand barriers to switching

Members:

A) 6 current member with a credit cardholder but low-usage rates

B) 6 current member with no credit card but other USAA products

A) 6 current member with a credit cardholder but low-usage rates

B) 6 current member with no credit card but other USAA products

View Insight Report

(Password protected)

View Research Plan

(Password protected)

View Discussion Guide

(Password protected)

High-level Strategy:

![]()

Nuanced Needs:

![]()

![]()

Assumptions from Senior Leaders:

Test Industry Recommendations

Build the ideal card

Quant 1: Affluent at Scale

I then partnered with an internal quant team to validate our sample size at scale.

DEFINITION:

Methods used: opportunity mapping, go-to-market hypothesis

With a validated card hypothesis the team mapped out go-to market opportunities.

Uncovered Challenges

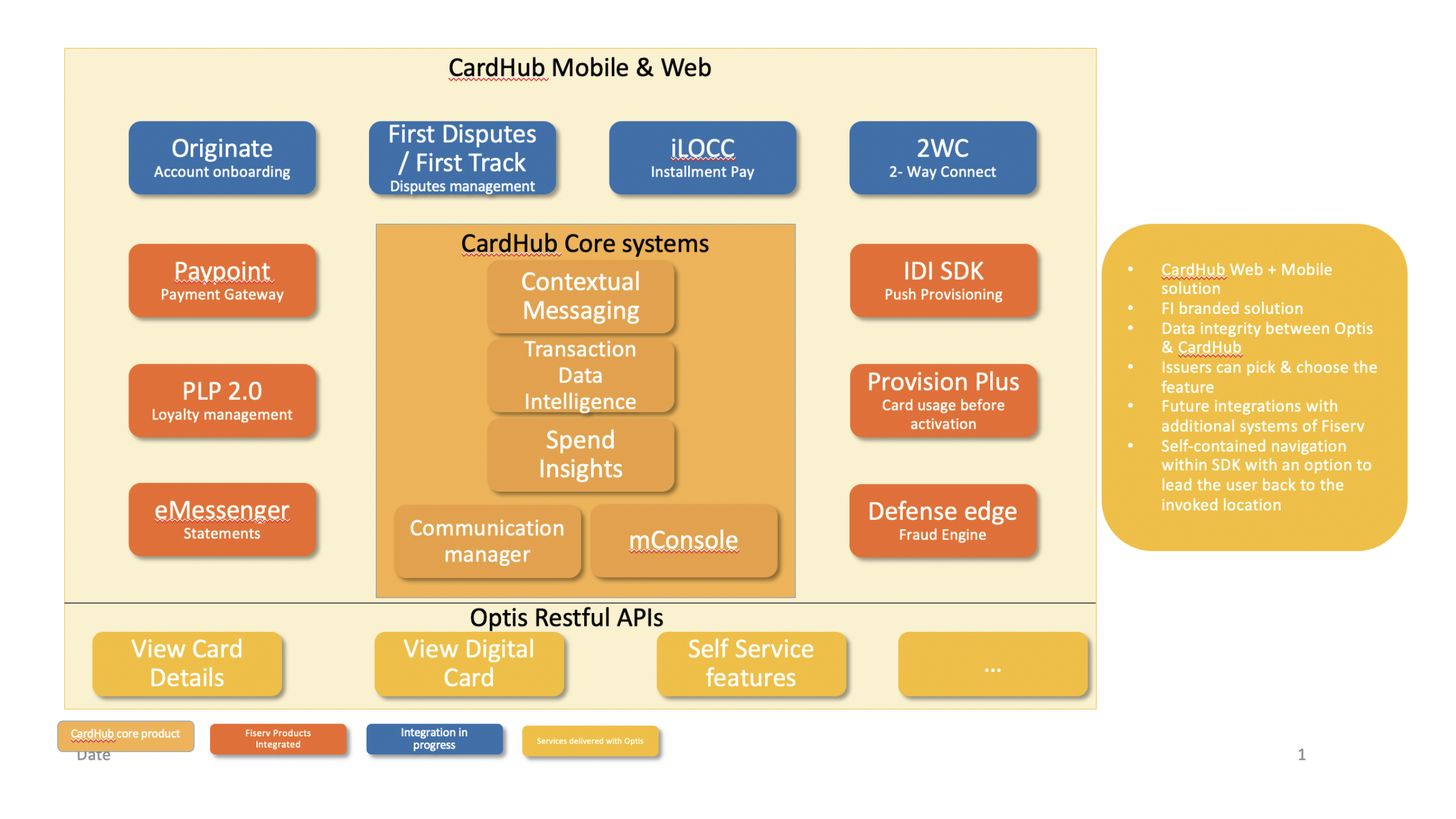

New Rewards Platform

The new redemption platorm meant the credit card needed to delay launching to market for a full-year to flush out the details of their new 3rd party integration.

New Tech API

New Tech API Speculation of a new set of API’s to sit on top of the new tech stack meant more a solid foundation for future growth, but in the short-term delays to market.

New Marketing Platform

In order to send targets and legal messages to customer the entire credit card team had to relaunch a marketing platform.

Reshuffling Credit Card Portfolio

To reduce the number of offerings and simplify the management on the cards. Refreshing of old cards mean they needed to be clear to not cannibalize and transition old card holders easily.

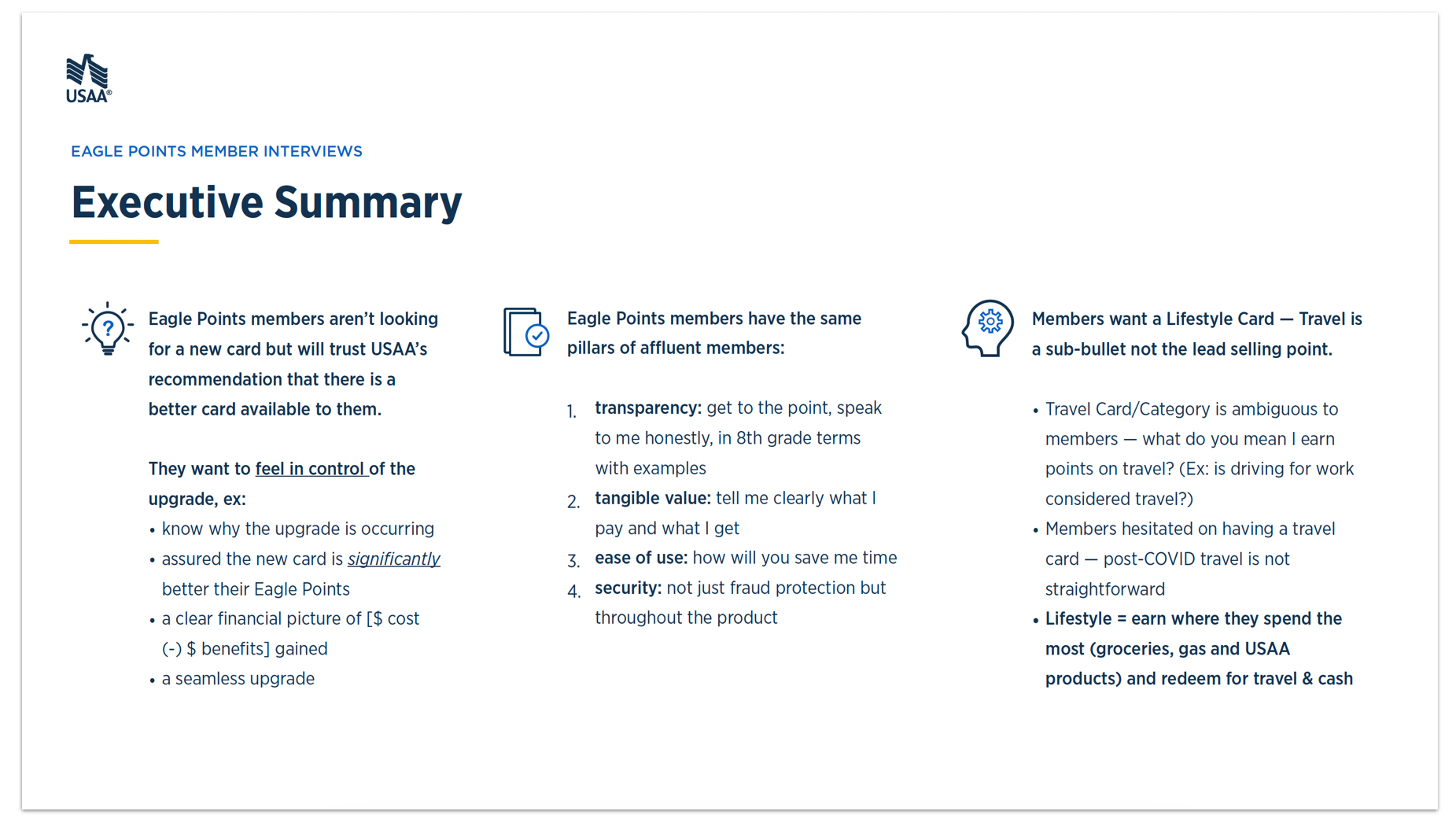

Qual 2: Eagle Points Card Holders

Background:

- Long-tenured, wealthy members over 30+ years with USAA

- Eagle Points card will be discontinued and want to ensure they won’t be mad and leave USAA

Resarch Goals:

-

Test affluent product recommendations from Qual 1

-

Understand if Eagle Points card holders will upgrade? any barriers?

-

Test the As-Is member experience from Acquisition to Application

-

Test value prop marketing content on As-Is Storefront Pages

Members:

A) 6 current member with a Eagle Points Card but low-usage rates

B) 6 current member with a Eagle Points Card card but dormat

A) 6 current member with a Eagle Points Card but low-usage rates

B) 6 current member with a Eagle Points Card card but dormat

Invision link

Success measures in 2023: 10,000 new acquisitions

Card set to launch in Q2/Q3 2023

MY ROLE:

I was a lead design strategist on the project from analyzing quant/quant research, facilitating design thinking workshops, conducting member research, defining insights and opportunities and follow-up evaluative research.

KEY LEARNINGS:

I was a lead design strategist on the project from analyzing quant/quant research, facilitating design thinking workshops, conducting member research, defining insights and opportunities and follow-up evaluative research.

KEY LEARNINGS:

- Design strategy is where design gets it’s highest return on investment. The return is 100x the further design is a part of the strategy vs. at the pixel where the return is 2x.

- Design strategy is the speculative arm of the business. Large enterprises can eliminate or reduce the guess from design strategist.

- Quality design strategy breeds recommendations of more design work from our partners — “hey you should talk with design about your effort, they can help you talk with members and give you product direction.”