Amazon Pickup & Return: Service Design

THE CHALLENGE

Amazon Pickup despite a highly rated NPS score, 60% of customers use the experience once — never to use it again. Why?

How might we ... improve adoption and frequency of Amazon Hub based on the customers?

Amazon Pickup despite a highly rated NPS score, 60% of customers use the experience once — never to use it again. Why?

How might we ... improve adoption and frequency of Amazon Hub based on the customers?

THE IMPACT

- Results non-conclusive due to 2023 Amazon layoffs, below is the team’s thinking and rationale

Why did Amazon Hub need Service Design?

Launched in 2011, Amazon Locker & Counters are a convenient and secure alternative to home delivery. At their core, it is a service design problem: creating innovative solutions on behalf of the customer by uniting a complex array of front and back-end services including: hardware, software, physical, digital experiences and processes. Now in 2023, the network had grown to 295k locations moving 267M package in 20 marketplaces — built on driving package throughput, but not getting return customers.

The Challenges

Near-term [focus]: set the customer strategy to drive repeat customers and deepen adoption, including:

- define the relationship between Hub value proposition and it’s global customers

- understand the gaps in our product & service offering

- validate existing business model in the context of geographically diverse customer needs

Far-term: structure product team organizationally based on Durable Customer Outcomes (JTBD). This ensures teams are grounded in the truth of users’ experience, needs and goals, regardless of business priorities, technology and product releases.

We believe that in the near-term ... qualitative data documenting firsthand knowledge of customer routines, nuanced needs and desires of our global customers will reveal why NPS scores can be high with unacceptable attrition rates.

Team’s Process

ALIGNMENT ︎ DISCOVERYALIGNMENT = 8 weeks

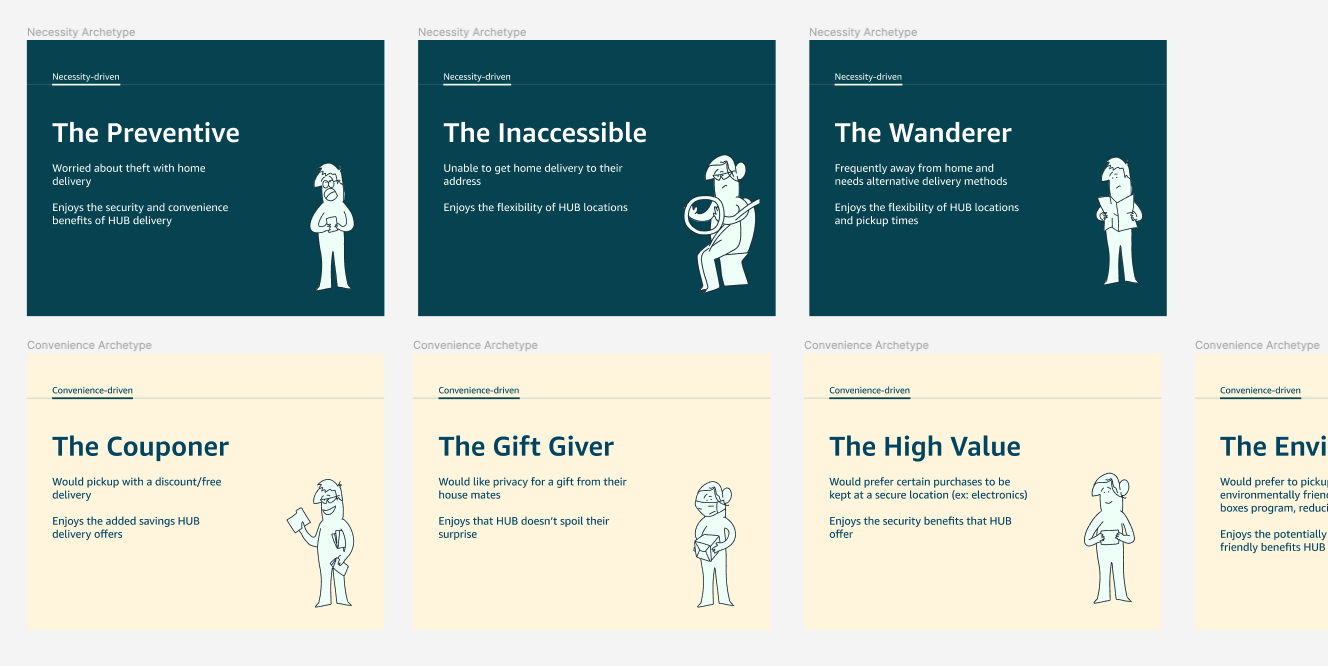

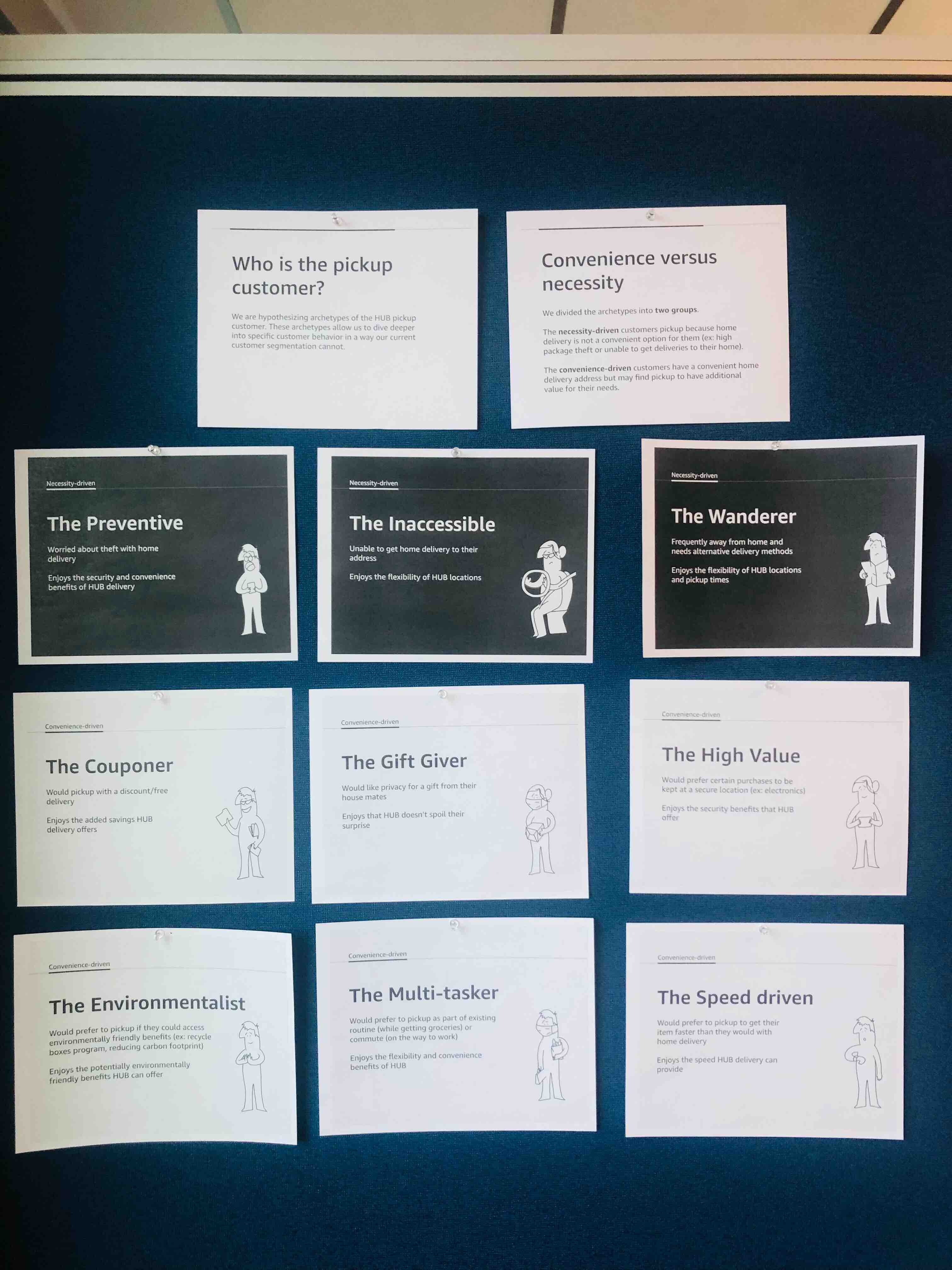

Identify internal stakeholders, customer archetypes and Jobs to Be Done draft.

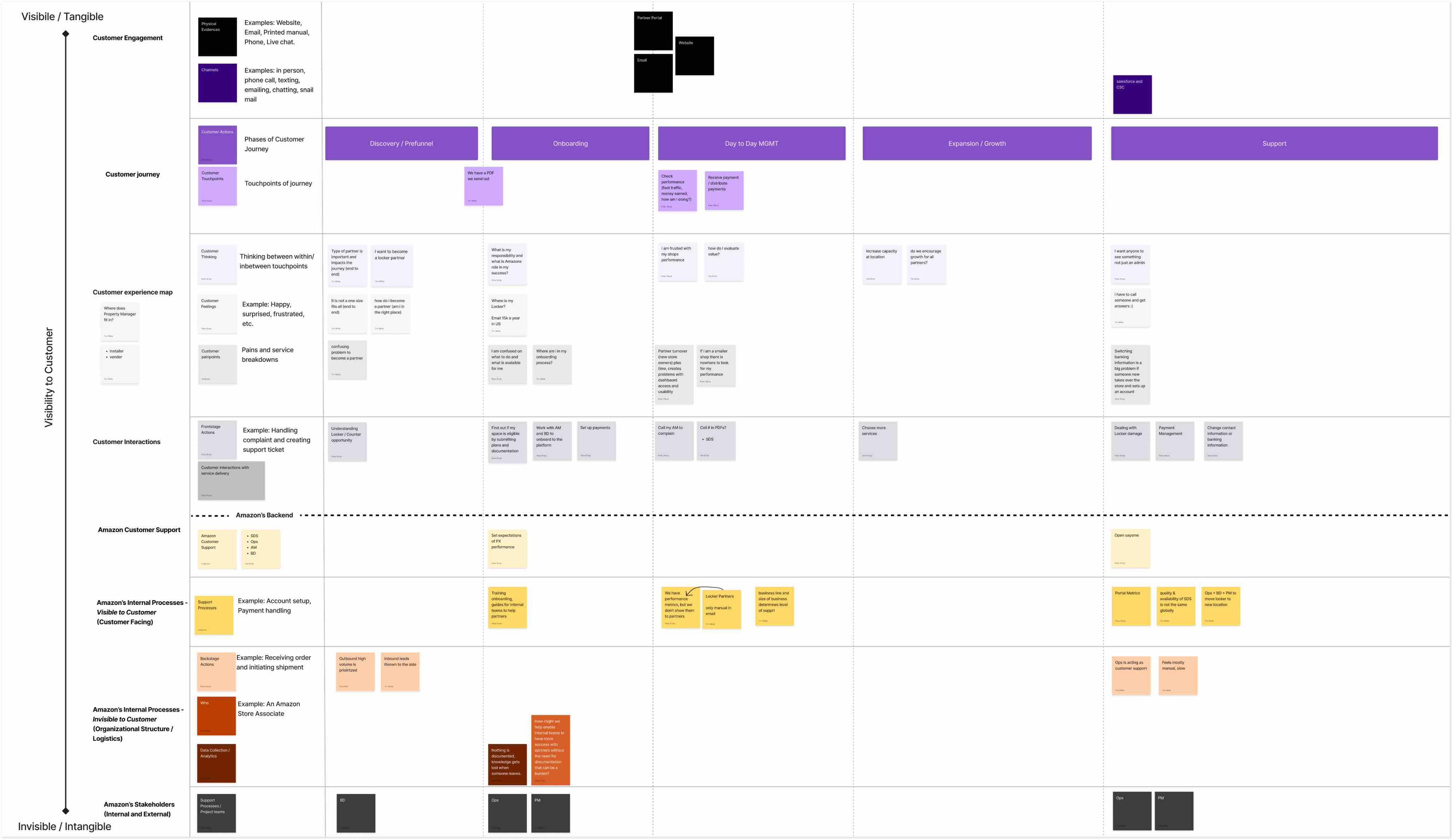

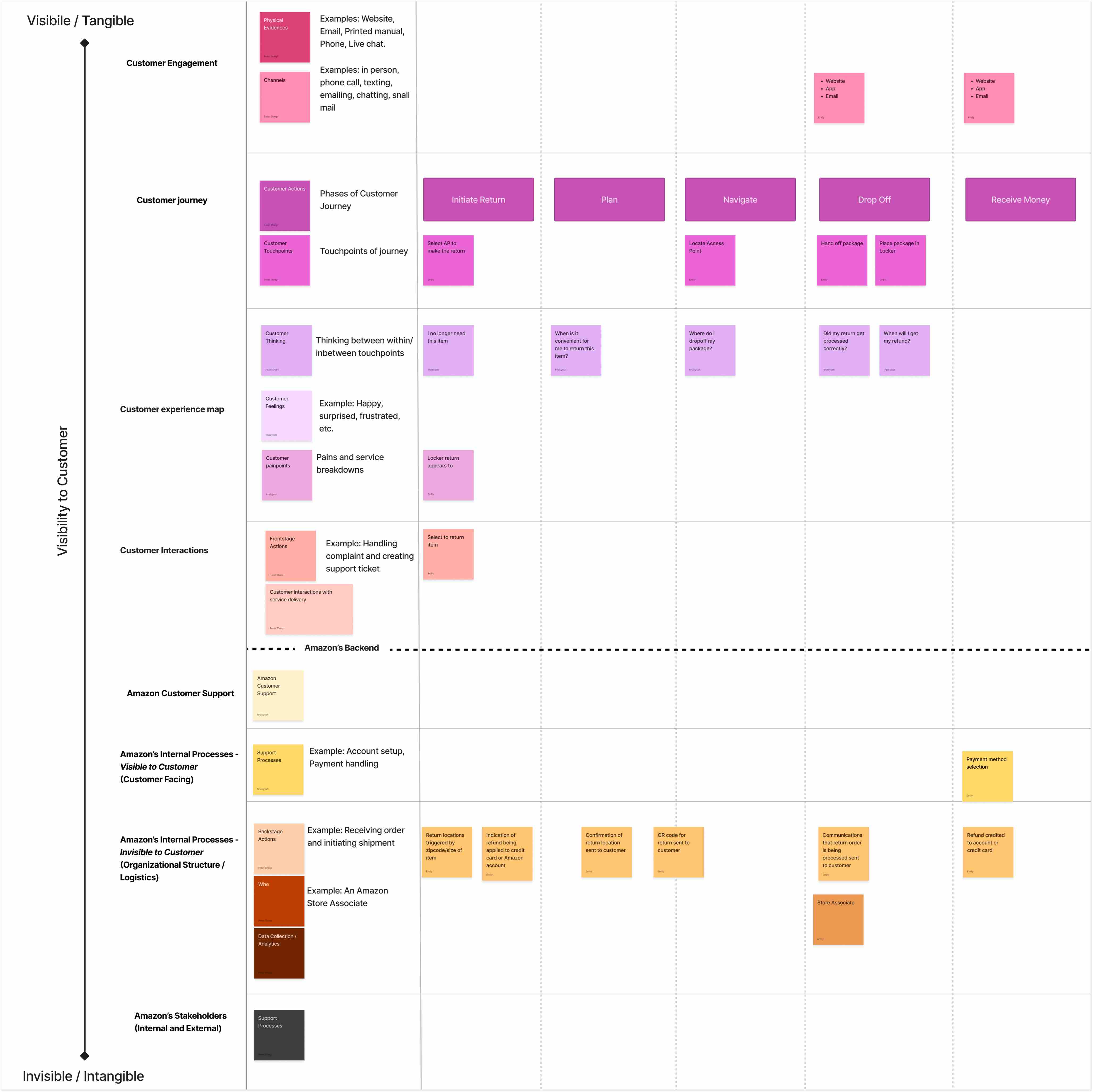

Define the Archetypes / Service Blueprint first draft.

Retail Customer Pickup

Retail Customer Pickup Hub Partner Pickup

Hub Partner Pickup Hub Partner Returns

Hub Partner ReturnsFeedback from internal stakeholders.

Peter Lead Service Designer on the project.

DEFINITION = 1 week

Research proposal to validating the reality of the Pickup Customer

Background of research:

Validate and expand our customer journey & archetypes globally, redefine Pickup success measures, increase instituional knowledge of the customer context and combine existing survey data with deep qualitative behavioral data to inform strategic investments by briding customer ROI with throughput metrics.

How we will execute:

Partner with region specific research agencies, guiding their methodologies and partnering on field research

Primary goals:

- Audit existing benchmarking studies and market research identfying current patterns and gaps.

- Define Hub value prop and validate customer perspective. (evaluating how pickup might be woven into lifestyles outdside of delivery

- Identify “moments that matter” and key actions customers take in the journey to inform future value prop

- Identify key customer behavior that indicates customer success and drives demand (ex: identify Customer Experience Outcome to roll-up to Jobs-to-Be-Done)

- Review current business model with customer needs, define the ecosystem that delivers the value prop with key leverage points to impact customer satisfaction and adoption rates. Includes new opportunities to impact existing business model.

Secondary goals:

- Identify value creation focus and the human needs that exist to tweak our strategy.

- Map operating model.

- Determine pickup and return nuances and complexities globally.

- Design principles.

Research Success Criteria:

- Impact product roadmap through re-prioritization and adoption of new design strategies

- Decrease atrrition rate by 5% by end of 2024

- Increase Amazon Fulfillment Network to Hub than Home by 2% by end of 2024

- Increase regular use metric across countries by 5% by end of 2024

Planned Deliverables:

- Create Customer Archetypes and Insights

- Customer Experience Outcomes framework

- Ecosystem Maps

- Analtyic Dashboard in Qualtrics

Location (leveage in-country connections)

Prioritized areas of business expansion:

Prioritized areas by marketing data:

Regular Use

Proposed Timeline

9. Canada - 19%

8. Germany - 20%

Prioritized areas of business expansion:

- US 23,373 — 17.5% YOY growth +3,473 locations (+2409 lockers, +1064 counters)

- Australia 1,072 — (+103 YOY lockers, -16 YOY counters, +200 YOY Locker+)

- Japan 4,717 — 35.5% YOY growth +(+1680 lockers, +0 counters)

Prioritized areas by marketing data:

Regular Use

- Spain - 52%

- Italy - 48%

- Mexico - 42%

- France - 37%

- UK - 30%

- Australia - 26%

- US - 22%

- Germany - 20%

- Canada - 19%

- Japan - 17%

Awareness Campaigns Increase Regular Use

- Japan

- UK

- US

- Australia

- Canada

- Germany

Proposed Timeline

2023

Primary markets with highest adoption rates:- Spain - 52%

- Italy - 48%

- Mexico - 42%

Primary markets with lowest adoption rates:

10. Japan - 17%9. Canada - 19%

8. Germany - 20%

Markets identified by business development for expansion:

- Japan

- US

2024

2025

- Follow-up on markets from previous year

- Secondary markets & expansion

2025

- Remaining markets

Research methods:

Target Customer:- 1:1 interviews with customers — build a deep understanding of customers past experiences, needs and expectations when it comes to pickup and delivery services through conversational interaction.

- Ethnographic field-focus research — observe how people behave and interact with pickup and return services. Identify behavioral patterns that customers weren’t able to articulate and might be counter to what they say they do.

- Dive deep on cultural, socio-economic factors — use secondary and primary research to identify tacit and cultural influences on customer mental models to better align strategy to adoption.

- Co-Design sessions — use focus groups to extract additional contextual information that helps us understand cultural perception of the services.

- Survey (Kano) — create comparative datasets between geographies to understand how customers rank various features and value adds of Hub products and services.

- Hub customers you used once and never again

- Hub customers who use infrequently

- Non-Hub customers (never used a pickup service)

- Potential Hub customers

- Bring life to our archetypes

- Quant and Qual from the following panels (prime vs non-prime, existing vs new to Hub, Counter & Locker, Multi-Family complexes)

Budget: 500k (±150)

Jobs to Be Done:

Align our product team to the JTBD framework.

![]()

Align our product team to the JTBD framework.

Quarterly Planning:

Aligning on most important work to deliver and our approach to do so.

Aligning on most important work to deliver and our approach to do so.

Challenges Encountered

Partners new to generative research and the gaps of market research.

Team was heavily data-driven but unclear to the benefits of using deep understanding of customer needs to drive strategy.

Team was heavily data-driven but unclear to the benefits of using deep understanding of customer needs to drive strategy.

Partners new to service design strategy. Using human-centered methods to dive deep on problems not first nature to our business and tech partners.

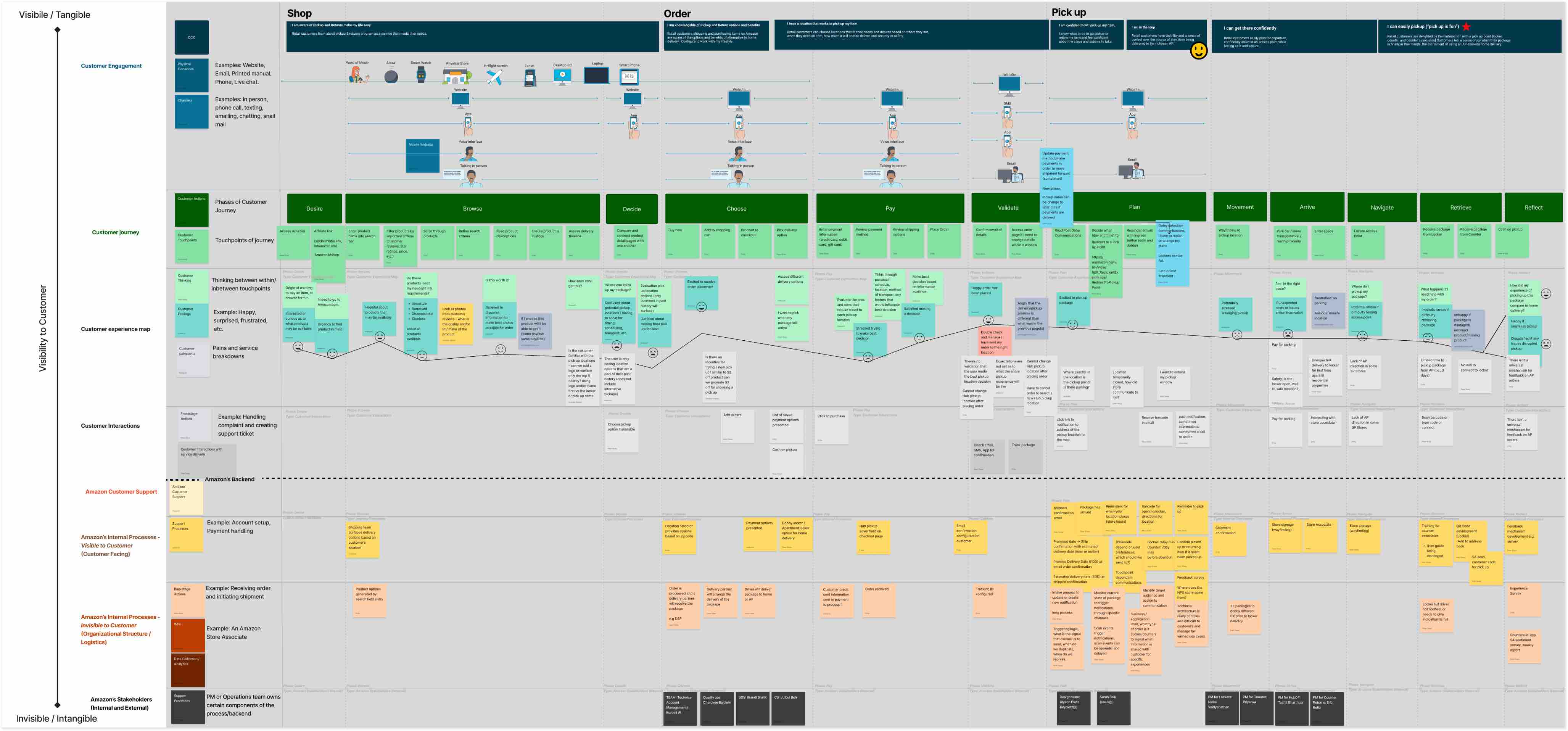

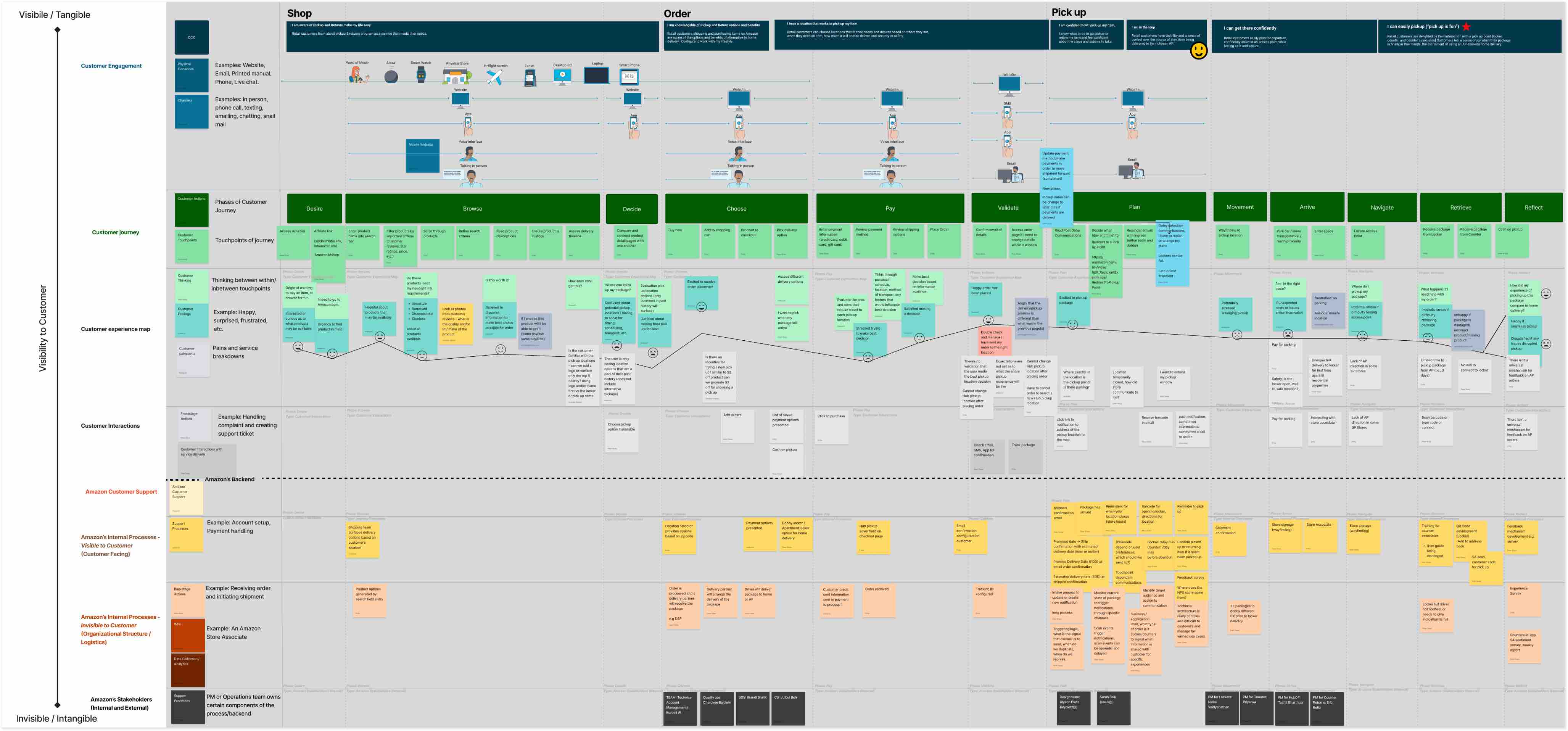

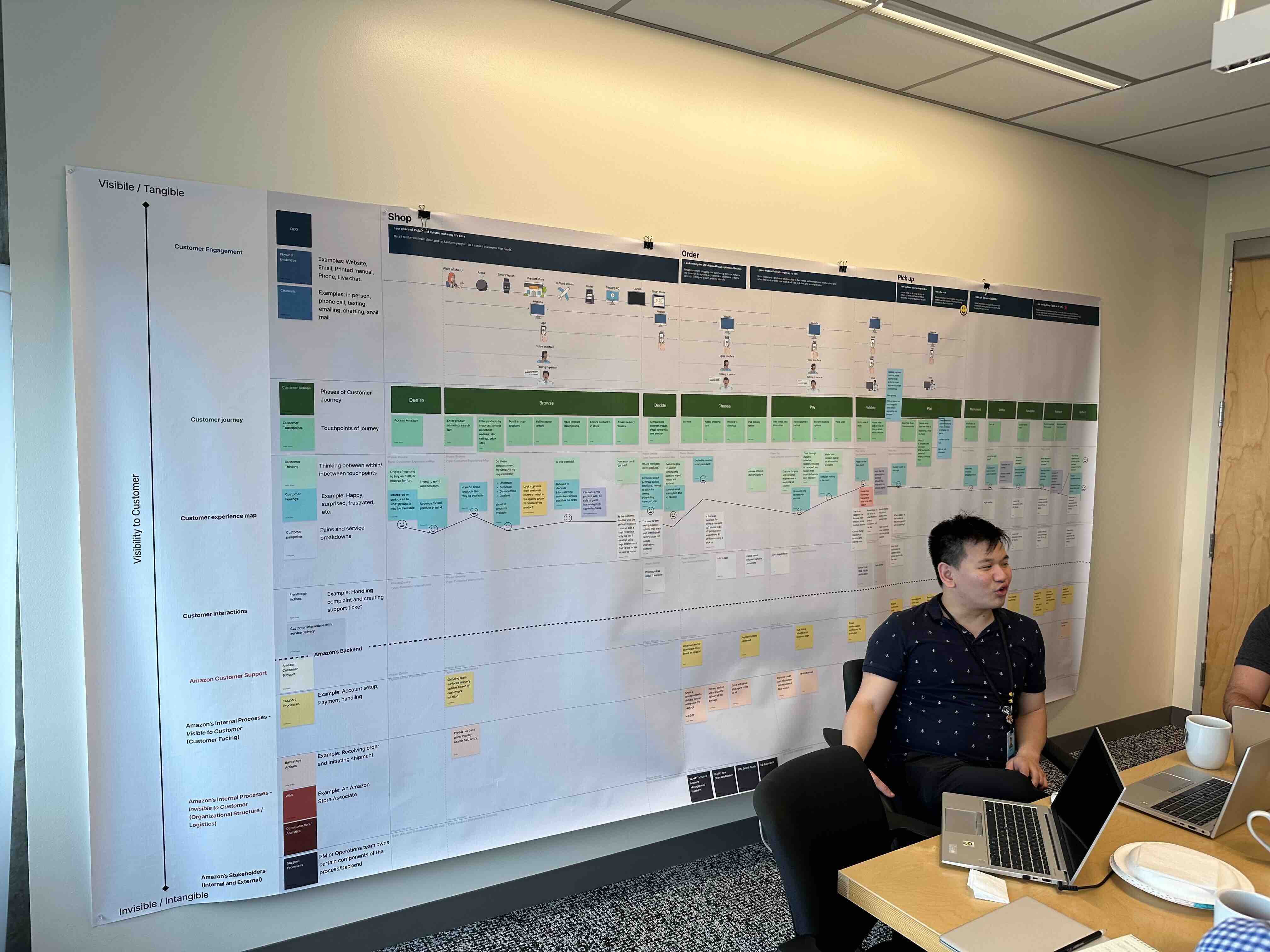

What is a Service Blueprint?

What is the outcome we hope to achieve?

What are participant expectations?

- A combination of a journey map + all the backstage supporting processes and interactions that go on behind the scenes to deliver a high end experience for a target audience.

- Documents end-to-end customer touchpoints through products and services.

- Displays customer successes and pain points.

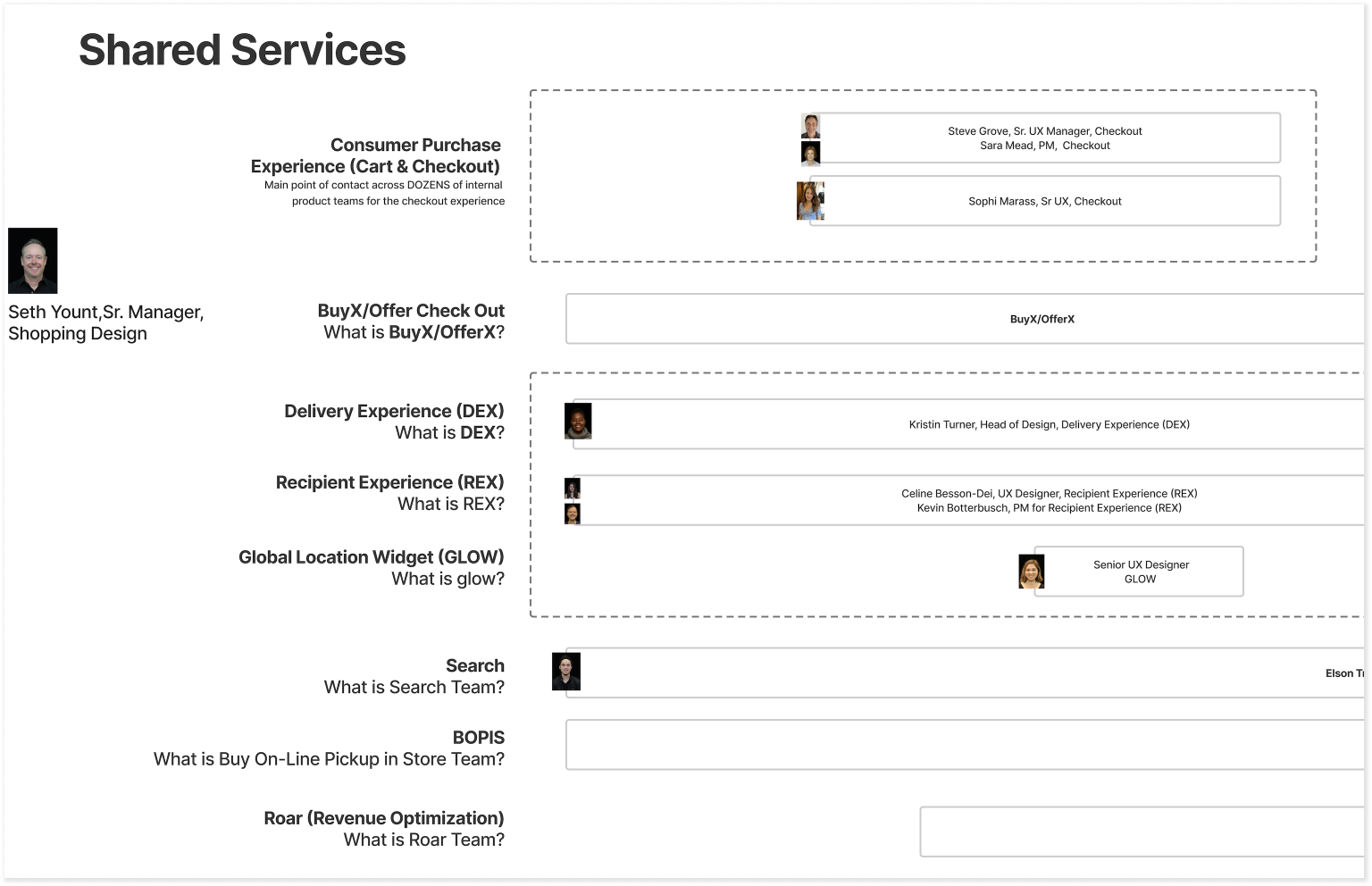

- Identifies key stakeholders.

- Acts as a living breathing document accessible by all to create shared understanding across the org.

What is the outcome we hope to achieve?

- By documenting all of these aspects that orchestrate an experience, we can:

- Break down silos and identify new areas of opportunity and collaboration across project teams.

- Create a holistic view of the entire end-to-end experience and optimize existing processes as well as innovate new solutions for customers.

- Identify gaps in our current structure, products, and services.

- Understand how all the components of the business impact one another.

What are participant expectations?

- Identify and add information that is a blind spot for us, we rely on your domain expertise to make this artifact valuable for everyone.

- Learn something new about the customer and partner experience that might have been a blind spot for your team.

- Learn about our Jobs-to-be-Done in Hub, and our customer behaviors and their archetypes.